All the content is provided for general information only and trade signals should not be construed as any form of regulated advice. It does not take into consideration your personal circumstances, including your investment objectives, risk profile, tax status, knowledge and understanding or financial situation. Past performance is no guarantee of future results.

Large companies in the United States have faced a bond issuance binge with a hasty supply pace that might become difficult to sustain. The situation worsened due to the recent US debt ceiling volatility. Meanwhile, financial experts have predicted a possible higher interest rate rise. Data shows that firms in the investment-grade niche accrued about $152 billion through May. This figure resulted in the busiest May since the pandemic debt issuances. In any case, firms in the junk-rated niche gained $22.1 billion, while 73 companies contributed about $49.1. Head of the United States Bond syndicate, Sir Richard Wolff, believes that issuance figures rose in May after officials pulled forward debt issuance. The current debt issuance spree might have resulted from the strong demand for higher-yielding corporate bonds. Remember, the Treasury yields increased in May from the lowest levels in April.

Further data indicates that bonds for firms in the new investment-grade category recorded three to four times the average orders’ offering size. Analysts say junk bonds recorded a higher demand since yields under 9% attracted record-high levels despite the energy crisis and pandemic. Nonetheless, the debt binge provides an insight that the world’s largest firms might not consider loans next year. The near-term funding rate will hike due to liquidity risks.

Analysts have predicted that the Treasury will give about $1.1 trillion in the new T-bills (Treasury bills) in seven months. In the meantime, the corporate bonds’ spreads charges, which are premium over credit spreads or Treasuries, remain stable. The stability adds to prospective borrowers' funding costs. Officials say macro factors like geopolitical risks, Federal Reserve interest rate hikes, inflation, large T-bill issuance, and the debt ceiling widen the credit spreads.

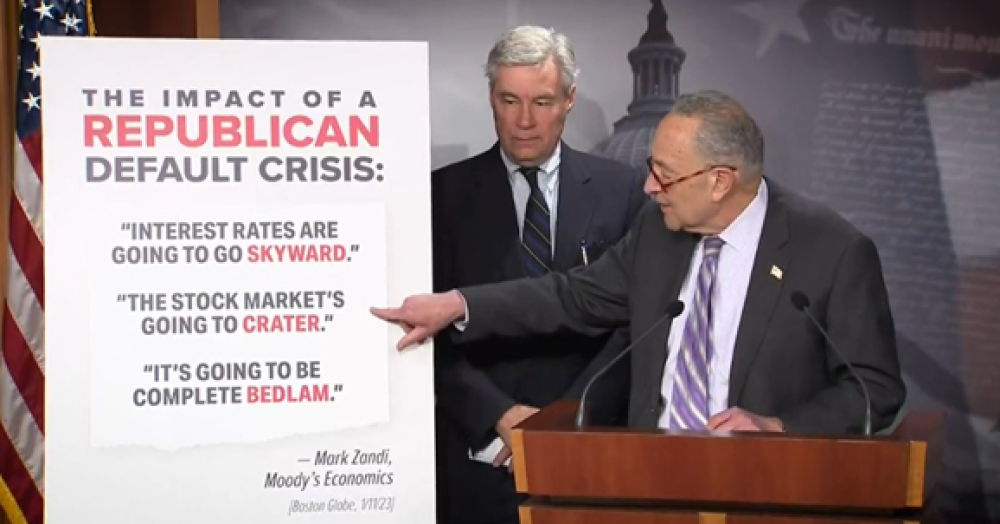

In general, investors in federal funds futures have predicted that the Federal Reserve will likely raise the borrowing cost rather than living it unchanged. While economic data surprises analysts, lawmakers opted to raise the borrowing ceiling. Although the Senate passed the bill on Thursday, experts still believe that liquidity will become an issue. The bill passed after bitter and intense negotiations between the White House and the House Speaker.

Overall, the bill gave conservatives numerous ideological victories in exchange for raising the debt ceiling. The borrowing limit rose beyond the 2025 presidential election. But experts say there is still a higher bar and credit sensitivity for less liquid and familiar issuers. Others warn that the bar could move higher if further market dislocations occur. Above all, the White House had a low-key reaction to the progress through Congress, but insiders say it could be a deliberate tactic not to alienate Republicans' votes.